Fashion Professor Magazine Year: 2 | Issue: 1 | January 2026

World’s First AI-Powered Fashion Magazine

Fashion Professor Magazine Year: 2 | Issue: 1 | January 2026

World’s First AI-Powered Fashion Magazine

Fashion Professor Magazine, Year: 1 | Issue: 1 | October 2025

World’s First AI-Powered Fashion Magazine

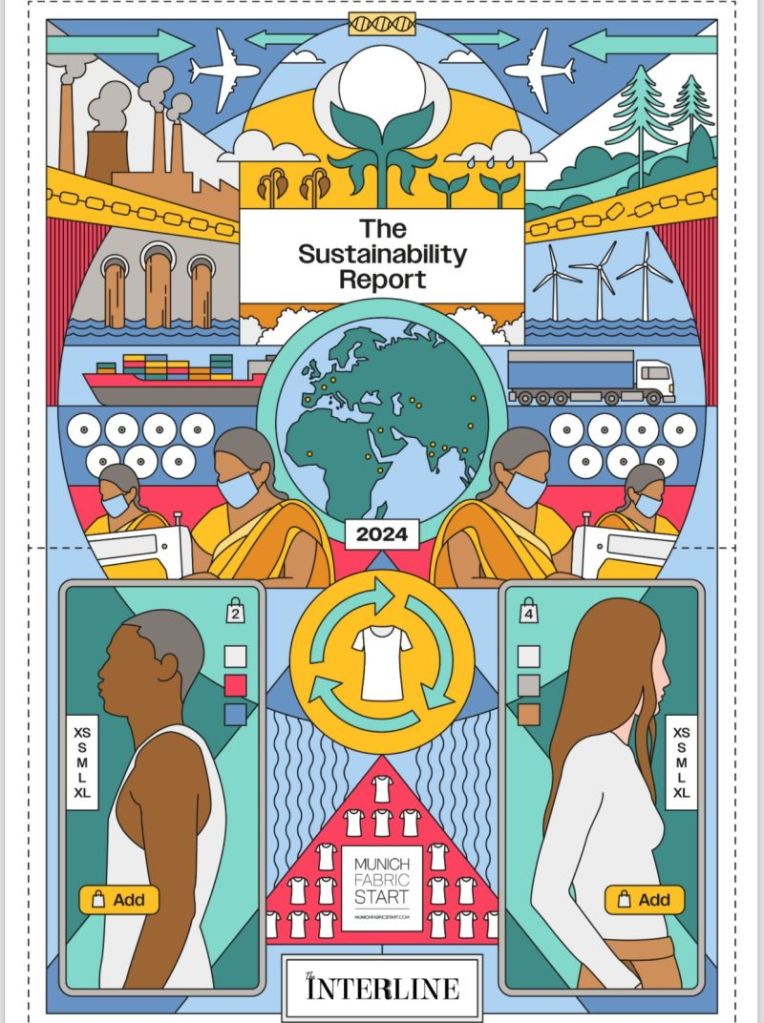

Our second deep-dive report on the evolution of technology for sustainability is now available to download, for free – covering the changing landscape of legislation, the mechanics of traceability, the outlook for skilled workers in a circular value chain, and much more.

Available to download from today, free and un-gated, The Interline’s second Sustainability Report spans 100 pages, featuring exclusive editorial from a range of industry perspectives, detailed technology vendor profiles and executive interviews, and an updated analysis of the market for sustainability solutions in fashion.

This year’s Sustainability Report is supported by Munich Fabric Start, and contains an exclusive foreword and insights from Managing Director, Sebastian Klinder.

Use one of the buttons below to obtain your copy. The “shareable version” will be the best fit for most readers, with a low filesize suitable for sharing with colleagues. This should open in a new browser tab, and can be saved from there. The quality version contains uncompressed images and artwork; it’s intended for offline reading on high-DPI displays, and archival, and should download automatically.

DOWNLOAD – SHAREABLE VERSION (26mb)

DOWNLOAD – QUALITY VERSION (138mb)

Building on the initial thoughts and findings set out in our Sustainability Report 2023, this 2024 edition examines how the definition of sustainability is shifting, and how technology solutions are evolving to meet it. It contains unique stories, told by industry figures, and key insights into how some leading technology companies are building the infrastructure and the experiences that fashion urgently needs.

Those stories include:

The Sustainability Report 2024 also contains detailed profiles of some of the key technology players who are defining what the foundations and the frontend experiences of sustainability solutions will be:

DOWNLOAD – SHAREABLE VERSION (26mb)

DOWNLOAD – QUALITY VERSION (138mb)

Look for The Interline’s final report for 2024 this December, with the release of The DPC Report 2024 – the next instalment of the definitive series of downloadable reports focused on the cutting edge of 3D tools, workflows, and solutions for fashion and footwear.

Find a full archive of our past reports – including the popular DPC Report 2023, the timely AI Report 2024, and the relevant Sustainability Report 2023 – in our report archives.

The Interline will announce its reports slate for 2025 early in the new year, and we will also continue to cover the industry’s hottest topics in news, interviews, editorials, podcasts, and partnerships all year-round.

Categories: Reports, Sourcing And Supply Chain, Sustainability And Circularity, Top Reads

Tags: Archive

Fashion technology” is the term used for incorporating technological advancements into the manufacturing and selling of fashion products. This concept has a wide range of applications in the fashion industry, including the sourcing, production, design, and retail processes.

Digital technology is also utilized in fashion technology to minimize waste and support sustainable practices. In addition to physical fashion items, prominent global brands are using Web3 and metaverse platforms to offer virtual fashion products.

The rise of fashion technology has given birth to “fashion tech experts,” who speculate that this trend may eventually form a distinct industry within the fashion sector. However, it is unclear whether this outcome is feasible.

Create an always-on, immersive virtual store that reinforces innovation, and makes your brand more memorable to consumers over time. Virtual flagships can be refreshed seasonally to align with your brand marketing and merchandising calendars.

The first MetaVerse Fashion Week is over, and depending on your vantage point it was either a roaring success or a dubiously half-baked initial showing for a vision that many brands have placed significant bets on being the Next Big Thing.

Before fashion runs full-speed towards the MetaVerse, there are fundamental challenges to solve – in both virtual and physical worlds.

The first MetaVerse Fashion Week is over, and depending on your vantage point it was either a roaring success or a dubiously half-baked initial showing for a vision that many brands have placed significant bets on being the Next Big Thing.

In terms of brand participation, nobody would argue that MVFW was anything but impressive. Big brands, big department stores, massive music artists, and arguably the biggest virtual landlord (an unwholesome title if ever there was one) were all represented, opening their collective doors to a customer base that seems, on the surface at least, to have transcended the established crypto-centric audience that defined last year’s NFT gold-rush.

Frame the whole affair from that audience’s point of view, though, and the cracks started to show themselves quickly. For an industry that trades heavily in aesthetics, the stylised (read: simplified) art of Decentraland, combined with the fact that the average visitor is probably using an integrated GPU, led to a pretty significant disparity between the level of visual fidelity that consumers want, and what was actually on show.

This is not, notably, intended to disparage the creative work that individual designers, collectives, and studios put into building visual garments. The level of artistry on show was at least on a par with what you’d expect to find in the constantly-impressive world of digital art, grassroots CG, and game character and environment design.

If the fashion corner of the MetaVerse has a problem, it’s definitely not a paucity of talent.

Facebook, now called Meta, has created a number of images to show how its metaverse might look.

The metaverse has the potential to become a $1 trillion annual revenue opportunity across the worlds of advertising, digital events, e-commerce and hardware, according to a new report from crypto giant Grayscale.

Grayscale’s report, released Wednesday night, comes during a surge in interest in the metaverse after Facebook officially changed its name to Meta as it focuses on the virtual immersive world it says is the future of the internet.

This week, there have been early indications of the potential size of the metaverse economy, with parcels of virtual land inside crypto-based metaverses Decentraland and Axie Infinity selling for more than $2 million.

The metaverse refers to a range of online 3D virtual environments, in which people can play games, build things, socialize, work and even trade and earn crypto assets.

The most well-known individual metaverses right now are in gaming, with Fortnite and Roblox booming in popularity over the last few years. Grayscale estimated that revenue from virtual gaming worlds could grow to $400 billion in 2025, from around $180 billion in 2020.

Yet Grayscale, which runs the world’s biggest cryptocurrency fund, said the metaverse is still “in its early innings.” It said Facebook’s plans to spend $10 billion this year on the metaverse is a sign of the potential of the market.

“The market opportunity for bringing the Metaverse to life may be worth over $1 trillion in annual revenue,” the report said, although it did not specify a timeframe.

The report’s authors, Grayscale’s head of research David Grider and research analyst Matt Maximo, argued the metaverse is a huge opportunity for crypto companies.

Many current metaverse projects, such as virtual realities or games, are run by so-called Web2 companies, which are centralized and operate for profit. Facebook, which has launched the virtual reality space Horizon Worlds, is an example.

But increasingly, metaverse projects are created on or are heavily tied to crypto technology, which can give users more control and allow them to earn money that they can use in the real world. This is known as the Web3 metaverse.

Grayscale listed the opportunities for monetization of consumers within the Web3 metaverse. These include art galleries launching NFTs, games and casinos where players win crypto, digital advertising billboards, and music venues where DJs and artists hold concerts.

In the third quarter, total Web3 and NFT fundraising hit $1.8 billion, out of overall crypto fundraising of $8.2 billion, Grayscale said. It added that investment has “recently started to accelerate.”

Grayscale’s report focused on Decentraland. In that metaverse, people log in to play games, earn the native cryptocurrency mana, purchase NFTs including virtual land and collectibles, and vote on the governance of the economy.https://7639fd23d5f81f9ba8e86110e7495846.safeframe.googlesyndication.com/safeframe/1-0-38/html/container.html

The crypto investment company recently created a Decentraland trust that invests solely in mana. The cryptocurrency is up around 550% in the last 30 days, according to Coingecko.

More

(Decentraland/ UNXD promotional video).

Decentraland/UNXD promotional video

Fashion is shaping up to be a key area of business in the potentially $1 trillion-a-year-metaverse, and Decentraland will expand its stake in the market by hosting its first fashion week.

The metaverse platform in March will host four days of runway shows and immersive experiences with UNXD, a luxury marketplace built on the Polygon blockchain network.

“Have your collections ready!” Decentraland said in a Sunday post on Twitter calling on designers, brands, and fashionistas to prepare for the event set for March 24-27, 2022.

The metaverse refers to online 3D virtual environments where people represented by avatars can play games, work and socialize, as well as buy and trade crypto assets. Cryptocurrency asset management firm Grayscale last month said the metaverse has the potential to become a $1 trillion annual revenue opportunity.

But all those avatars in the metaverse need virtual clothing, which is emerging as a hot sector.

Fashion brands such as Dolce & Gabbana, Gucci, Balenciaga, and Ralph Lauren have been making inroads into the metaverse. UNXD hosted Dolce & Gabbana’s first NFT clothing collection, and the Collezione Genesi group of nine non-fungible tokens designed by Domenico Dolce and Stefano Gabbana sold for $5.7 million in September.

Digital clothing from Ralph Lauren and Gucci have been featured on avatars through separate partnerships with avatar app Zepeto, Asia’s largest fashion virtual platform with nearly a quarter of a billion users, according to the BBC.

Meanwhile, Decentraland’s burgeoning Fashion District grabbed attention in recent weeks after a company paid the equivalent of $2.4 million in cryptocurrency to purchase virtual parcels there.

“We think the Fashion District purchase is like buying on Fifth Avenue back in the 1800s … or the creation of Rodeo Drive,” Lorne Sugarman, the CEO of Metaverse Group, told Insider, about his company’s deal in November.